Particularly with the advent of modern accounting and bookkeeping software, bookkeepers in smaller companies and nonprofits might take over more of the accounting process than just recording transactions; they can also classify and generate reports using the data gleaned from the transactions. It’s important to keep in mind that they may not have the education necessary to handle the tasks on their own, but it’s still possible because most accounting software will automate reports and memorize transactions. It makes transaction classification easier for bookkeepers and helps to blur the traditional lines between the two.

Accounting and Bookkeeping: The Difference

Ask most people about the difference between accounting and bookkeeping and they would probably ask right back, “There’s a difference?” In fact, there is. A bookkeeper and an accountant do share some goals, but they still support a business in different ways.

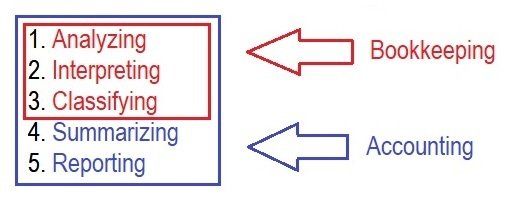

Since most people aren’t entirely certain of the difference between accounting and bookkeeping, they also wouldn’t know that both are needed for the financial health of literally any business (nonprofits, too). In short, the role of bookkeeping is to record financial transactions; the role of accounting is to analyze, interpret, classify, summarize, and report financial data.

The biggest difference between accounting and bookkeeping is the analysis and interpretation of data, which is something accounting does that bookkeeping does not do. For a more in-depth look, keep reading.

Bookkeeping

Bookkeepers make a chronological and consistent daily record of financial transactions. Bookkeeping is comprised of:

- Recording financial transactions

- Posting credits and debits

- Creating invoices

- Maintaining and balancing historical accounts, subsidiaries, and general ledgers

- Completing payroll

Special software can automate many processes, so some people who do the bookkeeping for small organizations are able to also classify and summarize the data in financial reports. Such bookkeepers are often called “full-charge bookkeepers.”

Maintaining a general ledger is a major part of bookkeeping. The general ledger is a basic document in which a bookkeeper records amounts from sale and expense receipts (also known as “posting”). Ledgers can be set up with special software, a standard computer spreadsheet, or just a lined sheet of paper. The complexity of any bookkeeping system typically depends on how big a business or nonprofit is and how many transactions are completed daily, weekly, and monthly. All sales and purchases made need to be recorded, and certain items need supporting documents. The IRS lays out which business transactions require supporting documents on their website.

Accounting

As noted above, the accounting process involves the recording, interpretation, classification, analysis, reporting, and summarization of financial data. Bookkeepers are responsible for the recording part, which is the beginning and the foundation of the entire accounting process; accountants handle all parts of the process. Accounting is more subjective than bookkeeping, which is largely transactional. Accounting involves:

- Preparation of adjusting entries (the recording of expenses that occurred but aren’t yet recorded by bookkeeping)

- Preparation of financial statements

- Analysis of costs of operations

- Completion of income tax returns

- Helping others understand the impact of financial decisions

The process of accounting creates reports that bring important financial information to the fore. This leads to a better understanding of actual profitability and an awareness of cash flow. Accounting converts ledger information into statements that show the bigger financial picture as well as the road the company is on. Businesses and nonprofits will often look to accountants for help with financial forecasts, tax plans, and tax filing.

Similarities

To an untrained eye, bookkeeping and accounting can look like the same profession. Bookkeepers and accountants both:

- work with financial data

- must have basic accounting knowledge

Sometimes, an accountant will also record financial transactions, which covers the bookkeeping part of the accounting process.

Differences

Taking courses and acquiring a basic understanding of accounting will qualify someone to be a bookkeeper. A good bookkeeper will have from two to four years of experience or an associateå’s degree, be knowledgeable about key financial topics, and be a stickler for accuracy. To be an accountant, someone must have at least a bachelor’s degree in accounting; to gain greater expertise, an accountant can go further and acquire other professional certifications, such as becoming a certified public accountant (CPA).

Accountants are qualified to carry out the entire accounting process, while bookkeepers are qualified to carry out the recording of financial transactions. Bookkeepers record and classify financial transactions, laying the groundwork for accountants to analyze the financial data. To ensure accuracy, accountants will often serve as advisors and review the work bookkeepers do.

How it Comes Together

The bookkeeper organizes financial records and balances finances. Combined with the accountant’s financial strategy and proper tax filing, both contribute important information that can be used to directly impact the long-term success of a business or nonprofit.

Some businesses and nonprofits may learn to manage their finances independently, while others choose to go the professional route so they can focus on doing what they love. Whichever option you choose, investing—be it time or money—in your financials will only help your business or nonprofit grow.

Dynamic change to tax laws made 2019 an historic year. Its been nearly 40 years since our nation experienced such a dramatic reshaping of the tax codes. Thank you for trusting and counting on No Doubt Accounting to deliver the best tax advice and outcomes for you, your families and your businesses. Allowing You to Focus Going into 2019, we invested countless hours learning, studying and understanding the new tax laws so wouldn’t have to. We believe our preparation was worth the time and effort. Judging from your feedback, you were able to focus on your businesses while our knowledgeable experts maximized your tax savings or refunds. Always Thinking of You As 2019 winds down, we continue to think of ideas to help you prepare and get the most out of the coming tax season. We are ready to help you with the following: Let us review your current Profit and Loss statement to make sure expenses and revenues are correctly input so there will be no “surprises.” Advise you about the tax benefits of transitioning your sole proprietor LLC to an S-Corp. For married couples, we can advise you whether it would be to your advantage to file jointly rather than separately to avoid a higher tax bracket. For small businesses, let us make sure your W-2s, 1099s and other tax forms are collected and properly recorded. So before you get too wrapped up in the Holidays (pun intended), give us a call. We may be able to help you find some extra funds to pay your Holiday bills! Let’s Make History Again And again, thank you for allowing No Doubt Accounting be your trusted tax advisers during this historic year. We look forward to making history again for you, your families, your loved ones and your businesses in 2020! Happy Holidays!

Saving the world may not be at the top of your list of accountant characteristics. Yet several leading service-oriented non-profit organizations rely on No Doubt Accounting for tax guidance so their leaders, staff and volunteers can focus on making a difference in the lives of others. Consider the work of many non-profits. Fighting hunger. Curing illness. Rescuing animals. Protecting the environment. Non-profit leaders cannot lose sight of these noble pursuits. Preparing financial statements, updating QuickBooks or staying current on tax laws is not their passion. That is when they turn to No Doubt Accounting. We Know Non-Profits As unique as the mission of each non-profit, so are their bookkeeping requirements. We help non-profits structure their financial reports and prepare 990 Forms so each organizations’ constituents and donors clearly see how their support is directed to programs that improve and, in some cases, save lives. Often non-profits operate on shoestring budgets. The thought of hiring an accountant may seem out of reach. At No Doubt Accounting, we offer special rates for non-profits. Our affordable fees ensure that non-profit personnel can pour their energy and passion into causes and not wasted on paying penalties for tax reporting errors. We Love Non-Profits Why are we so passionate about non-profit organizations? Because we believe it is our duty and our privilege to make our community, our nation and the world a better place. We frequently volunteer our time to serve on non-profit boards and participate in charitable projects. You could say non-profit work is in our blood. Our first client 18 years ago was a non-profit organization. Today, we still work with that original client and several other non-profits have joined our client portfolio. If you are a non-profit leader, please give us a call. We want to help you save the world!

Your business is unique. You offer one-of-a-kind products or deliver services unparalleled by your peers. Your business also comes with a distinctive set of financial practices. How you manage your firm’s finances is vital to your success. Fortunately for you, the No Doubt Accounting experts are familiar with virtually every type of business and have experienced an assortment of financial protocols. You need our confidence and experience on your side. Been There. Done That. Whether you own a flower shop or a trucking company, a retail store or a construction firm, and virtually any other business in between, we can provide your accounting needs. Track tips for hair salons and restaurants. Check! Manage reams of financial paperwork generated by construction companies. Check! Advise non-profits how to classify funds within programs. Check! Understand mileage deductions for trucking companies. Check! And this is just the tip of the iceberg. The Difference We Make What sets apart our experts are the questions we ask. We truly want to know your business so we can help you get the most out of your hard work through efficient tax strategies and abundant deductions. We do more than data entry. We get to know you, understand your goals and learn your business. With this knowledge, we create tracking systems and reports to help you make smart business decisions. When It Really Counts We get it. Every business has its own financial quirks. But there are few we haven’t seen. Don’t trust your business’ finances to just anyone. In today’s business environment, every dollar counts. Trust us to put our expertise to work for you. We’ll make certain every dollar counts for your success!

September is time for kids to get reacquainted with the Three Rs — R eading, w R iting and a R ithmetic. But September also is ideal for business owners to get familiar with the Three Cs of Quickbooks — C oaching, C ustomization and C orrecting. And you won’t find better Quickbooks teachers than the tax experts at No Doubt Accounting. Coaching If you are brand new to Quickbooks or simply need a refresher, our experts will coach you through the many facets of both the desktop or online versions. Setting up account receivables, learning how to process payments, entering or paying invoices, or any other task Quickbooks offers, let us coach you. Your time is valuable. With the proper coaching, we will help you get the most out of Quickbooks without losing precious time to trial and error. Customization Each training session is customized specifically for you. Your business is different from your peers. That’s why you are successful. Therefore, we customize your training so you can leverage the power of Quickbooks for your unique purposes. We can customize your Quickbooks reports so you have access to specific data in your Chart of Accounts to make sound financial decisions with confidence. Correcting Despite your best efforts, sometimes you input the wrong numbers or leave out vital information. If the numbers aren’t adding up or not even making sense, we can correct it. Our one-on-one coaching sessions are perfect for correcting errors so your numbers are accurate and informative in time for tax season. Certified Let’s go ahead and add a fourth C — C ertified. We are certified Quickbooks trainers. Why is that important? You can trust that we have spent hours training on Quickbooks updates each year so we can coach you on the latest tools and services. So don’t be tardy! Call us today to schedule your personalized Quickbooks training.

If launching a flip-flop sandal company seemed like a good idea while vacationing at the beach this summer, then make sure No Doubt Accounting is your first stop to determine the best business entity for you and your business. Why is choosing the right business entity so important? The success of your business, whether you are just starting or have been in business for years, may rest on selecting the right entity. What’s With the Alphabet Soup? So what is a business entity? Perhaps you have heard terms such as C-Corp, S-Corp, LLC, SP or GP. Let’s decipher these acronyms below: S-Corp = S-Corporation C-Corp = C-Corporation LLC = Limited Liability Company SP = Sole Proprietorship GP = General Partnership Which of these entities is right for your business? The experts at No Doubt Accounting can guide you in making the right decision. What Does It Mean? In a nutshell, some entities require quarterly payment of taxes. Others don’t. Some call for payroll services. Some don’t. Some entities necessitate the formation of a Board of Directors. Others have few legal requirements. Bottom line, each entity impacts your business’ tax requirements in one way or another. At No Doubt Accounting, we thoroughly understand the pros and cons of each entity for your particular situation. We will help you navigate the process and recommend the best entity to establish for your business. And, if your business requires legal counsel to formalize its structure, we can refer you to an attorney as well. Making Your Dreams Come True If you dream of owning your own business or you aspire to take your business to the next level, don’t hesitate to drop by or call us. We’ll help you determine the right business entity for you.

We work with some of the most dynamic, creative and talented entrepreneurs. These ambitious women and men launched their businesses to make a difference in their industries, their communities and in the lives of others. However, the day-to-day grind of running a successful business can discourage even the most passionate business owner. That’s where No Doubt Accounting can lend a hand, especially when it comes to managing payroll services. No Hassle There’s no question, payroll services can be intimidating and overwhelming. We eliminate this concern with our no contract, no hidden fees approach. And because we bill by 15-minute increments, our service often is more affordable than most flat-fee models. No Worries Staying current with rapidly changing payroll tax charts and laws, not to mention worker’s compensation reporting, can burden any business owner. Our payroll specialists are well versed in the latest revisions. Business owners rely on our payroll experts to help them navigate the new laws and prepare for on-time filing of annual reports and tax forms. No Lost Time Time is money. Keeping track of time is easier said than done. We simplify the time-tracking process through electronic timesheets. Business owners praise this time-saving technology. And it allows us to monitor and share information quickly to ensure accurate tracking and billing. No Doubt Your business is important to you. We want to help you succeed. Trust No Doubt Accounting with your payroll services so you can focus on what you do best.

Summer usually conjures up thoughts of cooler destinations such as the beach, a mountain lake or the local swimming pool. But summer also is the ideal time to re-evaluate your business’ bookkeeping practices. If everything is in place, don’t forget the sunscreen before heading outdoors. If not, the experts at No Doubt Accounting can help put your financial records in order so you won’t be burned at year’s end. To DIY Or Not DIY Do-It-Yourself methods may work when tackling a home repair or crafts project, but it may not be the best approach when it comes to bookkeeping. Organizing your firm’s financial records and keeping them current can be overwhelming. Falling behind may cost your business time and money. Allow us to save your company time and money — and potentially find ways to increase your bottom line. To the Rescue We will come to you or you can come to us. Our on-site bookkeepers integrate quickly into your business to help make your record-tracking efforts more efficient. Or if you send your financial documents to us, either physically or digitally, we will put them in order and make them accessible to you when you need them. Whatever approach works best for your business, we will make it happen. The Check Is In the Mail In addition to keeping your financial records in shape, we can customize, update and manage your payroll services. Just think, no more data entry or researching new tax laws. We’ll do all of that and more. We are here to help you focus on your business and not be distracted. Enjoy So slip on your flip-flops, grab your beach chair and a good book. With No Doubt Accounting handling your bookkeeping and payroll services, you’ll be able to do more than dream about cooler locales. You’ll enjoy them.

With the year’s major tax deadlines in the rearview mirror, the No Doubt Accounting team can keep you and your business focused on the journey ahead, making sure you reach your financial destination now and in the future. Tax Tune-up For businesses on a quarterly tax payment schedule, let our tax experts take a look under the hood of your financials. A quick diagnostic test will determine if you are paying too much or too little. Correcting the former will give you funds to grow your business now. Fixing the later will make sure you are not surprised with a huge tax payment at year’s end. Stop by soon for your personalized assessment. Don’t put it off as the year’s second quarterly tax payment is due June 15. QuickBooks Training For those who prefer the do-it-yourself approach and aren’t afraid of getting a bit of grease under your fingernails (figuratively speaking!), we offer QuickBooks training on both desktop and online versions. If simply tinkering is your preference, we have a two-hour training session just for you. If you are looking to do a complete financial overhaul, our experts can provide multiple training sessions to improve your QuickBooks proficiency. The Right Tools Our tax experts know that no two businesses are alike. Just as a pickup truck requires a completely different set of tools to fine tune the engine than a European sports car, our tax experts understand the nuances of your business and possess the proper skills and tools to address them. Whether you own a trucking company or a salon, run a non-profit organization or a retail store, we understand your unique tax situations and can help you. Road to Success Thank you for putting your trust and confidence in our No Doubt Accounting team. We enjoy being your go-to accounting experts. We are committed to providing your business with the best tax advice and accounting services to keep you on the road to financial success.

While there were significant changes in Federal tax laws this tax season, two things did not change — the trust and confidence you, our clients, both returning and new, demonstrated in the No Doubt Accounting team. On behalf of the entire No Doubt Accounting family, we wish to express our gratitude to each of you for relying on us to guide you through one of the most challenging tax seasons. Year of Change Increased take-home pay, adjustments to tax brackets, revised standard deductions and a host of other changes contributed to the complexity of preparing 2018 tax returns. Fortunately, our team was prepared. After long hours of studying new tax codes and literally going the extra mile to travel to attend multi-hour training sessions, we were ready to deliver the best tax counsel and recommendations available. More Time with You The several changes in tax laws required our team of experts to spend more time with you explaining code revisions and recommending options to secure optimum outcomes for you, your family and your business. With the crush of tax season behind us, if you desire further explanation about your 2018 tax return, please don’t hesitate to contact us. It is our pleasure to spend additional time with you to ensure you understand your unique tax situation. And while were talking, let’s look ahead to 2019. For personal filers, we may be able to recommend steps you can take now to improve your tax situation in the coming year. For business owners, we can project your quarterly tax payments and help you avoid overpayments. Finally, if we helped you file an extension for your 2018 tax return, we continue to be here for you to answer your questions and complete your return. Our Privilege Thank you for the privilege to be your trusted tax advisors. You work hard for your money. We work as hard — or harder — to make sure you keep as much as your hard-earned dollars as you can to benefit you, your family or your business.

Few dates on the calendar cause the heart to race and blood pressure rise like Tax Day — April 15. If you are experiencing these symptoms, a good dose of counsel and assistance from the tax experts at No Doubt Accounting may be your best remedy. March Madness As Tax Day looms, March turns into a mad dash around your office or home gathering receipts and collecting tax documents. A little more legwork on your behalf may be the difference between filing on time or filing for an extension (more on this later). Here are a few tips to help you in the crunch: No Doubt Accounting Tax Organizer — If you have it, use it. The Tax Organizer is your checklist to identify essential documents needed to complete your tax return. Previous Year’s Tax Return — No Tax Organizer, no worries. Reference last year’s return for clues about income generation and expenses that may apply to your 2018 tax return. Do the Math — Any calculations you make prior to submitting your tax information to the No Doubt Accounting team will shave time off the preparation of your return. Extension? No Problem. Despite your best efforts, and the efforts of the No Doubt tax professionals, filing for an extension may be your only option. Filing for an extension is not a bad thing. The No Doubt tax experts will guide you through the process. They will alleviate your fears, and make sure your tax return stays on track until it is finally submitted to the IRS. Count On Us No Doubt Accounting staff will work tirelessly to prepare your tax return in a timely fashion. However, we understand life happens and your best laid plans may not come to fruition. In those situations, count on us to assist you in filing your taxes in the most appropriate manner.